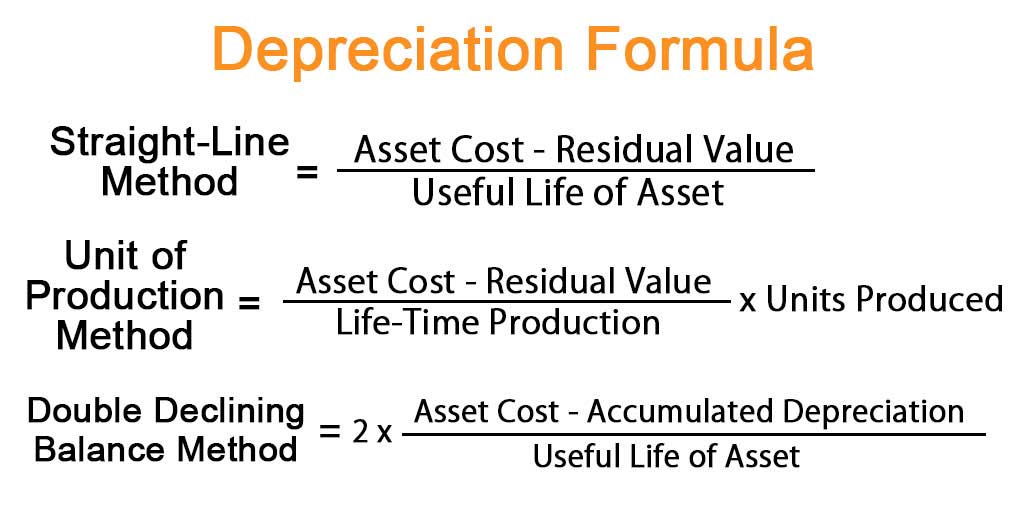

The following is the formula and example that could help to illustrate the above definition, Formula:

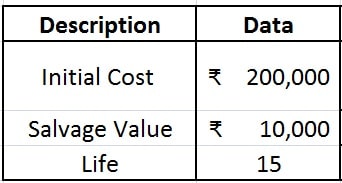

In this case, we should not use the straight-line method to depreciate the machine. This method does not apply to the assets that are used or performed are different from time to time.įor example, the production machine that is high performing in the first few years and then the performance is slow eventually. Then the depreciation expenses that should be charged to the build are USD10,000 annually and equally. And if the cost of the building is 500,000 USD with a useful life of 50 years. Therefore, the fittest depreciation method to apply for this kind of asset is the straight-line method.

The straight-line depreciation method considers assets used and provides the benefit equally to an entity over its useful life so that the depreciation charge is equally annually.įor example, the office building is naturally used by entities consistently and equally every month and year. This method is quite easy and could be applied to most fixed assets and intangible fixed assets.

The straight-line depreciation method is one of the most popular depreciation methods used to charge depreciation expenses from fixed assets equally period assets’ useful life.

0 kommentar(er)

0 kommentar(er)